Pakistan which has been reeling beneathneath intense monetary crisis, is now placing burden on its human beings to achieve IMF loan, keep away from default and make stronger its economic position. The cash-strapped South Asian state has slapped new PKR one hundred fifteen billion taxation measures in a bid for a huge bailout.

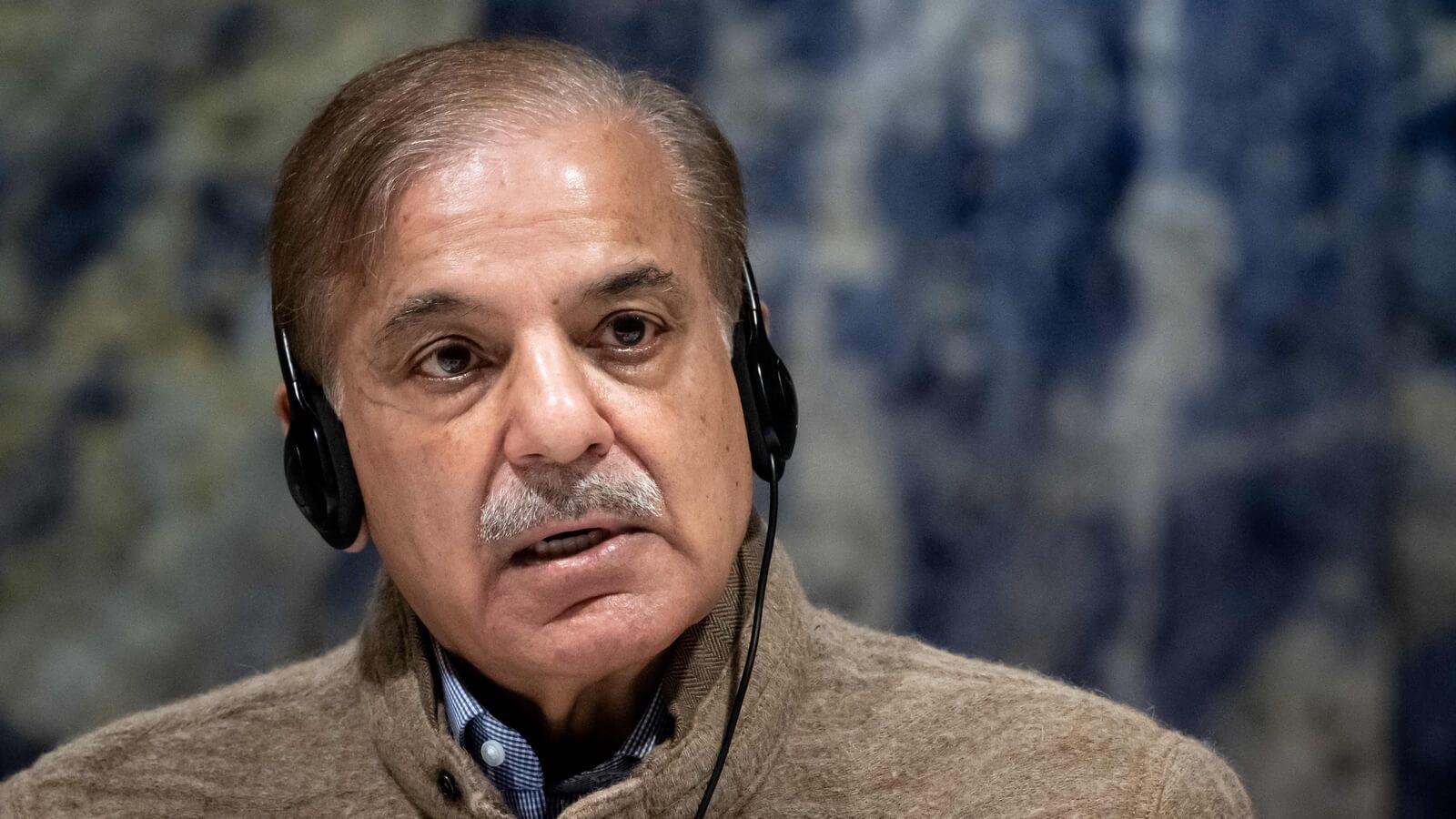

Late on Tuesday night, the Shehbaz Sharif-led authorities imposed taxation measures thru a notification issued through the country`s Federal Board of Revenue (FBR) after President Dr Arif Alvi denied promulgation of ordinance for unveiling a mini-finances if you want to adhere to the International Monetary Fund (IMF) conditions.

Post mid-night, with the begin of 15 February, the same old fee of General Sales Tax (GST) has been improved from 17 according to cent to 18 according to cent in Pakistan.

Sales tax is chargeable on all regionally produced and imported items besides pc software, hen feeds, drugs and unprocessed agricultural produce of Pakistan and different items laid out in Sixth Schedule to The Sales Tax Act, 1990.This means, human beings of Pakistan will should pay extra for all of the commodities that they buy withinside the country.

The assertion of hike in GST fee become made through FBR withinside the Statutory Regulatory Order (SRO) once you have approval from the federal cupboard on a mini-finances withinside the form of Tax Laws Amendment Bill 2023.

Excise obligation on cigarettes improved

The Federal Excise Duty (FED) on cigarettes has additionally been improved if you want to fetch a further PKR one hundred fifteen billion out of PKR a hundred and seventy billion agreed to through the Pakistan authorities in step with the IMF conditions.

Luxury gadgets to price extra

Local reviews quoted pinnacle authorities officers pronouncing that the GST will now be levied on maximum of the high-cease luxurious gadgets on the fee of 25 according to cent. The assertion of this may be made on Wednesday (15 February) whilst the Tax Amendment Bill 2023 may be tabled withinside the Pakistan parliament.

GST fee on all imported luxurious gadgets, maximum of which have been banned through the Ministry of Commerce someday back, had been improved. Also, idea to elevate the fee of the income tax on a few regionally synthetic luxurious items is predicted to be made withinside the parliament today.

Beverages to come to be expensive

Reports stated that the authorities will boom FED on beverages, sugary beverages and juices from thirteen to twenty according to cent and it’d be made part of the Tax Amendment Bill 2023, in order to be laid down withinside the parliament.

The Pakistan authorities has convened the National Assembly consultation at 3:30 pm (neighborhood time) on Wednesday, and the Senate at 4:30 pm to put down the Tax Amendment Bill 2023.

As according to reviews, Pakistan`s Finance Minister Ishaq Dar become scheduled to announce the salient functions of the mini-finances thru a televised speech final nighttime however it become cancelled on the final hour.

Dar instructed the media that once attending federal cupboard assembly he had asked the president to promulgate an ordinance however Alvi declined. The President as a substitute advised to the authorities that the invoice ought to be delivered for implementing taxes.

Dar in addition stated that he instructed the president that there have been taxation troubles involved. He stated that it’d be hard for the authorities to look forward to extra eight to ten days due to the fact sure measures could have a economic effect however the president refused to entertain the request.

The finance minister said that the authorities followed the alternative direction and directed the FBR to trouble an SRO for trekking the GST fee.IMF `difficult conditions` for useful resource to PakistanThe IMF stated that it expects Pakistan to take steps to fill the huge economic gap. One of the proposals of the worldwide lender is to boom petroleum levy through PKR 20-30 a litre.

Another attention is to rate 17 according to cent GST on petroleum, oil and lubricant (POL) products.Or growing the GST fee through 1 according to cent from 17 to 18 according to cent thru a presidential ordinance,” The News International newspaper quoted unnamed reassets pronouncing.